Validation, Compliance & Qualification

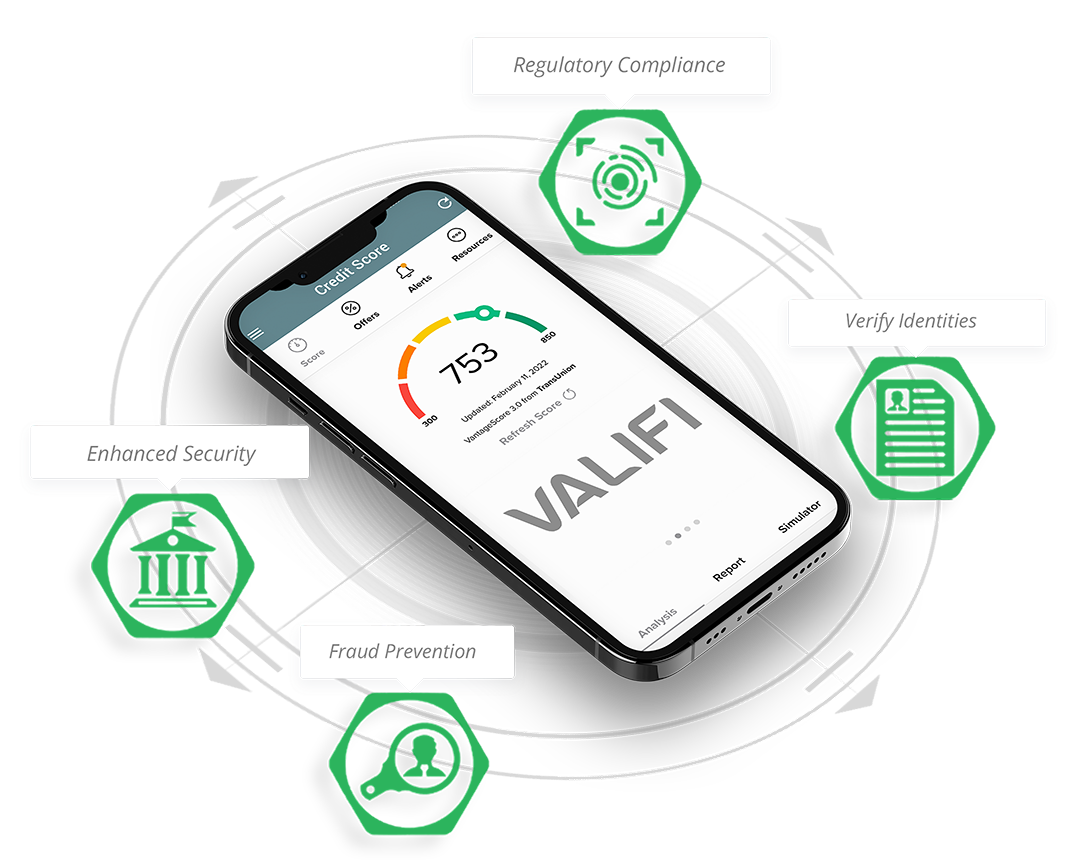

Empowering businesses and consumers with comprehensive credit data, identity verification, and compliance solutions. We partner with FCA authorised firms to deliver trusted credit reference services.

"Our mission is to place customers at the heart of everything we do, delivering streamlined onboarding experiences while ensuring their protection."

— D Wade (MD)

We source credit data from leading UK credit reference agencies to provide accurate, up-to-date information.

Comprehensive Data Insights

Streamline consumer insights, ensure compliance, and make better-informed decisions with comprehensive credit data and verification services.

AML Checks

Ensure compliance with anti-money laundering regulations. Identify and mitigate potential risks from money laundering and fraud to protect your business reputation.

KYC Verification

Know Your Customer compliance made simple. Verify customer identities quickly and accurately while meeting all regulatory requirements.

Credit Data

Access comprehensive credit reports and scoring. Get a clear view of financial health to enable informed decisions and reduce risk.

Identity Checks

Biometric identity verification for unmatched security. Reduce fraud with fast, seamless customer authentication using unique physical traits.

Tailored for Every Need

Whether you're a business seeking verification services or a consumer looking to understand your credit, we have the right solution for you.

Valifi My Business

Enterprise-grade verification and compliance solutions designed to streamline your customer onboarding and risk management.

- Comprehensive AML & KYC screening

- Real-time credit data access

- Proof of address verification

- Biometric identity checks

- API integration available

- Dedicated account support

Valifi Me

Take control of your financial health with tools to monitor, understand, and improve your credit standing.

- Monthly credit score updates

- Credit report monitoring

- Custom alerts for changes

- Personalised improvement tips

- 24/7 ID protection monitoring

- Easy-to-understand traffic light system

Why Your Credit Score Matters

If you have a good credit score, your chances of being approved for loans and credit cards increases. You're also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Track Your Progress

Monitor how your financial decisions impact your credit health over time.

Custom Alerts

Get notifications about significant changes to your credit report.

Hints & Tips

Get personalised advice to improve your credit score based on your profile.

Frequently Asked Questions

Have questions about Valifi and our services? Find answers to the most common questions below.

Why is Valifi on my credit file?

How often is my credit report updated?

What is the traffic light system?

Will checking my credit report affect my credit score?

How can I improve my credit score?

What does ID protection include?